Predictive Power Like Nothing Else

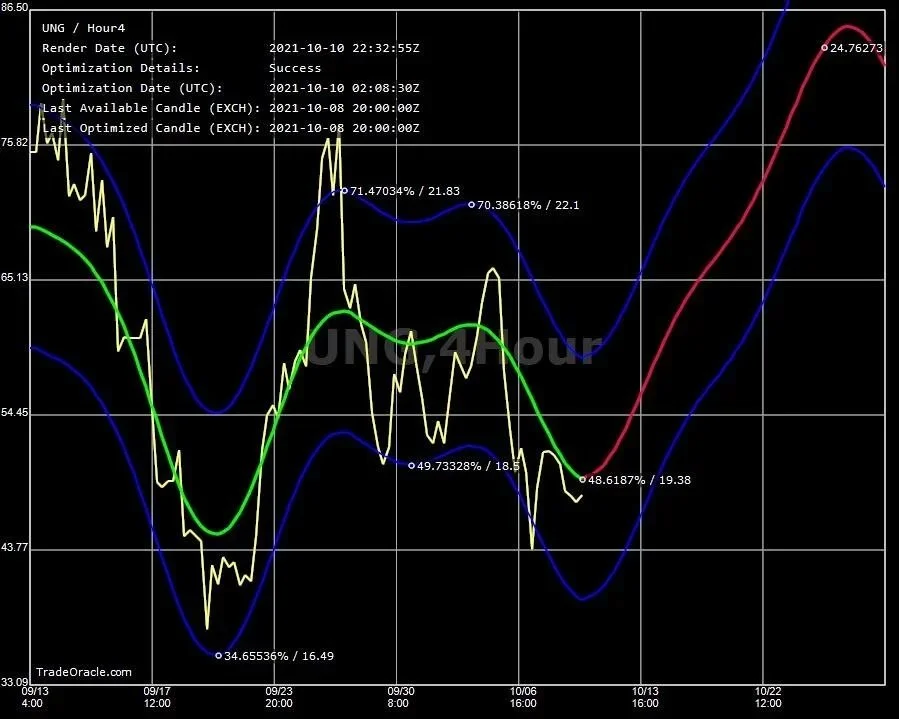

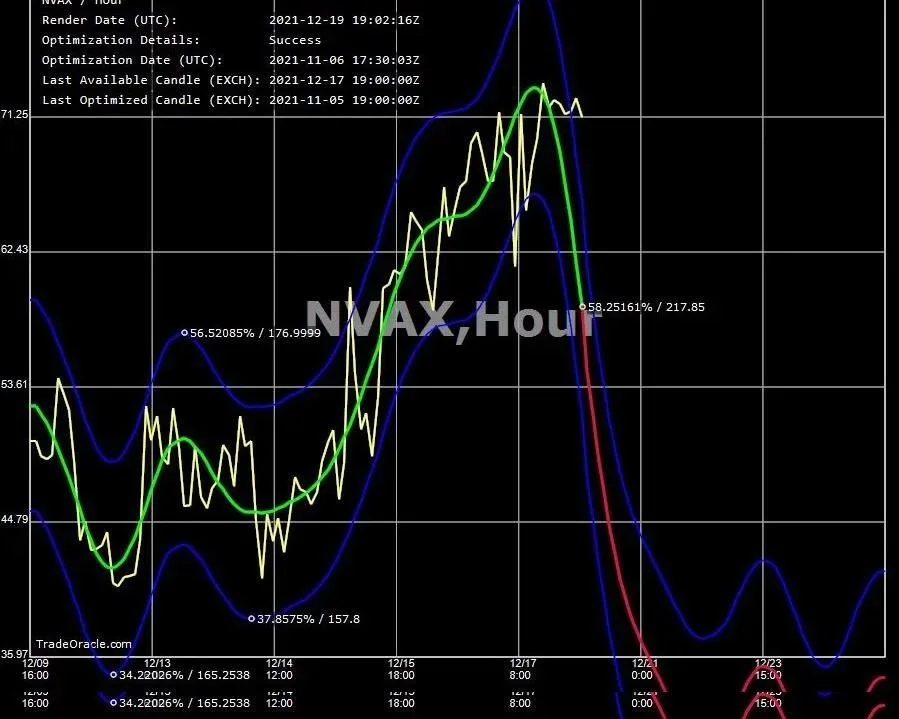

Trade Oracle’s proprietary FLOW software is wholly unique in that it brings together a multitude of stochastic, oscillator, parabolic, fractal, and geometric market analytics into an easy to view picture of the direction where the markets are likely headed.

About Us

VISION & MISSION

Step into the future of financial exchanges with our pioneering brokerage and day trading platform. Driven by cutting-edge technology, we revolutionize your trading experience by turning visionary insights into actionable strategies.

Our Vision:

“To transform active portfolio management into a disciplined, risk-aware practice that consistently delivers superior risk-adjusted returns for investors worldwide.”

Our Mission:

“To empower disciplined active managers to generate alpha and outperform their peers in any market environment through an integrated suite of tools that combine opportunity identification with comprehensive symbol and portfolio risk management.”

THE TRADING ECOSYSTEM

The Trade Oracle Group believes there are three critical components for family offices, institutions, and corporations seeking to optimize their market exposure and protect capital in volatile commodity markets.

Market Intelligence

Understanding directional trends in the metals, energy, and commodity markets that impact your business or portfolio is not optional—it's essential for strategic decision-making. Our predictive technology provides the forward-looking insights that allow sophisticated market participants to anticipate price movements rather than react to them, transforming uncertainty into strategic advantage.

Strategic Positioning

Whether you're a corporation managing input costs, a family office seeking alpha in commodities, or an institution hedging portfolio exposure, your approach must align with your specific risk profile, time horizons, and business objectives. Our suite of tools enables you to match your hedging strategy or investment approach to the precise market conditions and symbols most relevant to your operations.

Comprehensive Risk Management

At the institutional level, risk control isn't about individual trade sizing—it's about portfolio-wide exposure management, correlation analysis, and systematic approaches to protecting capital while capturing opportunity. Our platform delivers the symbol-level and portfolio-level risk analytics that ensure your positions remain aligned with your risk parameters across all market environments.

SUPERIOR TECHNOLOGY

FLOW is a technical tool that uses complex algorithms to identify trends across multiple time frames by analyzing historical data to identify replicating patterns in historic data. The FLOW methodology employs proprietary statistical techniques to obtain cyclical information from price data. Other proprietary frequency domain techniques are then employed to obtain the cycles embedded in the price. These trends and cycles are combined and presented in graphical representation so as to predict the future trend with associated confidence intervals resulting in high levels of accuracy, especially when used across multiple time frames.

TRADE ORACLE FOUNDERS

The Trade Oracle Group founder and CEO, Richard Lackey, has been actively engaged as a professional trader, hedge fund manager, and system builder for almost four decades. Recognizing that markets are dynamic, he has typically focused on portfolio design that includes consideration for multiple time frames, market cycles and pattern repetition. After discovering patterns that predicted other patterns and meeting an incredibly bright Navy scientist and a former CBOT floor trader, things came together quickly. Using more than a billion data points and massive parallel computing power the team was able to project predicted patterns of almost any symbol across multiple time frames in graphic form.

For more than thirty years the predictive power of this amazing technology hasn’t changed. Since the founder is now largely focused on philanthropic work, his team has automated everything. What is now called FLOW creates thousands of charts showing the predicted forward price action of every symbol. The FAZE technology reviews all of the symbols in the database to filter for the largest expected movers by percentage (stocks, ETFs, futures, forex, and crytpo).

Trade Oracle’s FLOW Technology

How is FLOW Different?

Traditional cycle analysis attempts to isolate only a few cycles or tries to identify a basic wave form. While occasionally successful, most programs ignore the many other cyclical forces impacting a market. FLOW identifies all the predominant cycles in a data stream, extracts them, and gives them a weighting based on their predictive value. The program then establishes the most likely convergence of patterns and projects that into the future.

When this system was originally created it took weeks and weeks to process the data on just a few symbols. Cloud computing and massive parallel computing now allows us to continually look at hundreds of the world’s most active Stocks, ETFs, Futures, Forex and even Crypto symbols.

FLOW makes good traders great! FLOW is a technical tool that uses complex algorithms to identify trends across multiple time frames by analyzing historical data to identify replicating patterns in historic data. The FLOW methodology employs proprietary statistical techniques to obtain cyclical information from price data. Other proprietary frequency domain techniques are then employed to obtain the cycles embedded in the price action. These trends and cycles are combined to predict the future

FAZE identifies the symbols with the largest predicted moves, out of thousand in the database, across multiple markets, and multiple sectors to increase the likelihood of investment funds earning more and risking less. 2,000 leading US Stocks, Major Futures, ETFs, Vanguard Funds, ProShares, Forex, and top ten Crypto are all available on FAZE

Signals are derived from the time-series-stacking models created by the Trade Oracle Group (TOG) founders. When multiple time series show patterns of accelerating momentum up or down, FLOW derives target entry and exit prices, which are sent in real time to your desktop or mobile. Select your symbol group and let FLOW Signals alert you with target entry and exits.

FLOW + FAZE + FLOW Trade Alerts. Get all three powerful tools in one discounted membership. Identify the symbols with the largest predicted moves. Get alerts on symbols that show multi-time-series confirmation, and the FLOW predictive charts together.

The Trade Oracle Group Power Portfolio Newsletter shares predictive insights born from FLOW technology and our proprietary trade ideas for multiple markets. The Power Portfolio Newsletter is delivered weekly for actionable ideas throughout the week.

Dynamically managed portfolios reduce risk and optimize portfolio makeup by consistently focusing on the highest probability long and short positions. FLOWfolio was created by professional traders and hedge fund managers who have combined their proven trade selection and management systems with FLOW and FAZE technologies for a comprehensive and dynamic portfolio management system. Trade Oracle Group makes it easy. First, subscribe to FLOWfolio. Then customize your portfolio(s) using our tools